How to Open FAB iSave Bank Account Online

If you’re looking to open a savings account in the UAE without stepping into a branch, the FAB iSave account might be exactly what you need. It’s fast, easy, 100% online, and the best part is you don’t even need a minimum balance.

So if you’ve been wondering how to open FAB iSave Bank account online, I’ve got you covered. Let’s walk through it step by step, and I’ll also break down everything you need to know before signing up.

What Is FAB iSave Account?

The FAB iSave account is a digital-only savings account by First Abu Dhabi Bank (FAB), tailored for UAE residents who want to earn high interest rates without the hassle of paperwork or physical visits.

Here’s why so many people are switching to iSave:

- 100% online setup, no branch visits

- No minimum balance required

- Competitive interest rates (subject to FAB’s terms)

- Easy transfers and deposits

- Fully managed through the FAB Mobile App

It’s basically a smart savings tool that fits right into your phone.

How to Open FAB iSave Bank Account Online

Opening an iSave account is simple and can be completed in minutes. Just follow these steps:

Step 1 – Go to bankfab.com Savings and Investments section.

Step 2 – The above link will redirect you to the iSave account option.

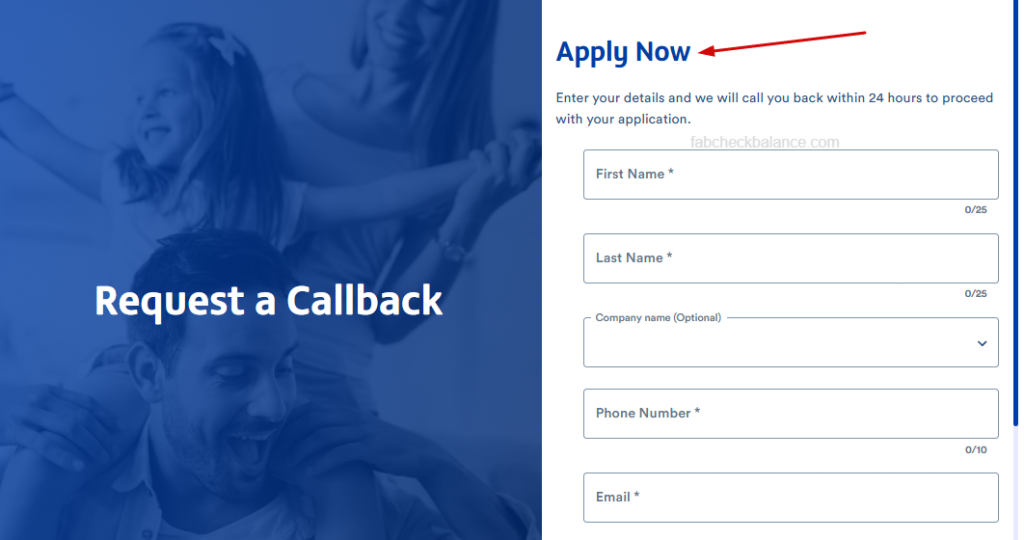

Step 3 – Tap the “Apply Now” button to begin your application.

Step 4 – You will need to provide all required information:

- First Name

- Last Name

- Company Name (if applicable)

- Email Address

- Emirate of Residence

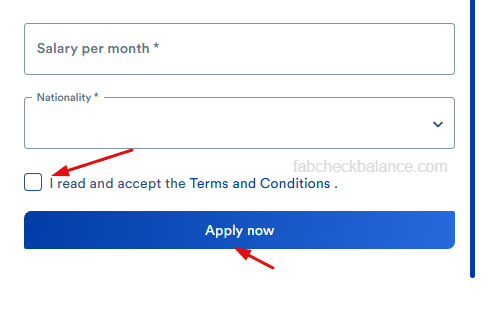

- Monthly Salary

- Nationality

Step 5 – Tick the checkbox to confirm you accept the terms and conditions.

Step 6 – Click the second “Apply Now” button to submit your application.

Step 7 – In some cases, you may need to print and sign your application form, then visit a nearby FAB branch to complete the process.

Requirements to Open a FAB iSave Account

Before we get into the steps, here’s what you’ll need:

- A valid Emirates ID

- A working UAE mobile number

- An existing FAB Current or Savings Account

- The FAB Mobile Banking App installed on your phone

Note: If you don’t already have a FAB account, you’ll need to open one first. The iSave is only available to existing FAB customers.

Benefits of Opening a FAB iSave Account

The FAB iSave account is packed with benefits that make it ideal for individuals looking to maximize their savings:

- Earn 5% Annual Interest: This promotional rate is one of the most competitive for personal savings accounts in the UAE.

- No Minimum Balance Requirement: Unlike many traditional accounts, you don’t need to maintain a specific balance to keep the account active.

- Unlimited Withdrawals: Enjoy full flexibility to withdraw funds at any time, with no penalties or limits.

- AED-Based Account: The iSave account is available in UAE Dirhams, making it simple and convenient for everyday banking.

Where to Apply FAB iSave Bank Account

To open your account online, visit the official First Abu Dhabi Bank website: bankfab.com

From there, navigate to “Accounts” > “Savings” > “iSave Account” and follow the guided steps. The platform is mobile- and desktop-friendly, making it easy to apply anytime, anywhere.

How Much Interest Does FAB iSave Offer?

Interest rates vary depending on FAB’s monthly rates and your account balance. They’re usually more competitive than traditional savings accounts, and the best part, you get paid monthly interest.

Is FAB iSave Account Safe?

Absolutely. FAB is the largest bank in the UAE, and the iSave account is backed by industry-standard encryption, biometric login, and Smart Pass OTPs for added security. Your money is safe, and your data is protected.

FAQs

Can I open a FAB iSave account if I’m not a UAE resident?

No. Only UAE residents with a valid Emirates ID are eligible to open an iSave account.

Can I open FAB iSave if I don’t have a FAB account yet?

No, you must be an existing FAB account holder. You can open a standard FAB account online or at any branch first.

Is there a minimum salary requirement?

FAB does not publicly list a specific salary requirement, but your income is part of the application form.

Can I open the account through the FAB mobile app?

While you can manage the iSave account through the FAB Mobile app, the initial application should start on the official website.

How often is the interest credited?

Interest is calculated monthly and applied according to your average balance, with special campaign bonuses credited within 45 days after the campaign ends.

Is this account Shariah-compliant?

The FAB iSave account is a conventional savings account and is not specifically marketed as Shariah-compliant.

Are there any charges or fees?

No. The FAB iSave account has zero fees and no minimum balance requirement.

Final Thoughts

Opening a FAB iSave Bank Account online is a great step if you want an easy, interest-earning savings solution in the UAE. With its high return rate, zero minimum balance, and full flexibility, the iSave account makes it simple to grow your savings without extra effort. Just make sure you meet the eligibility criteria and act within the promotional window for the 5% rate.

So if you’re ready to take control of your financial goals, this is your sign to start today.